(PM SVANidhi Yojana, पी एम स्वनिधि योजना, PM Street Vendor’s AtmaNirbhar Nidhi, पीएम स्ट्रीट वेंडर आत्मनिर्भर निधि, street vendors, Covid-19, lending loan, digital transactions, Ministry of Housing and Urban Affairs, Government of India, last date extended, December, 2024, March 2028, cashback, interest subsidy, Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014, Urban Local Bodies (ULBs), Letters of Recommendation (LoRs), Town Vending Committees (TVCs), Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Cooperative Banks, SHG Banks, Stree Nidhi)

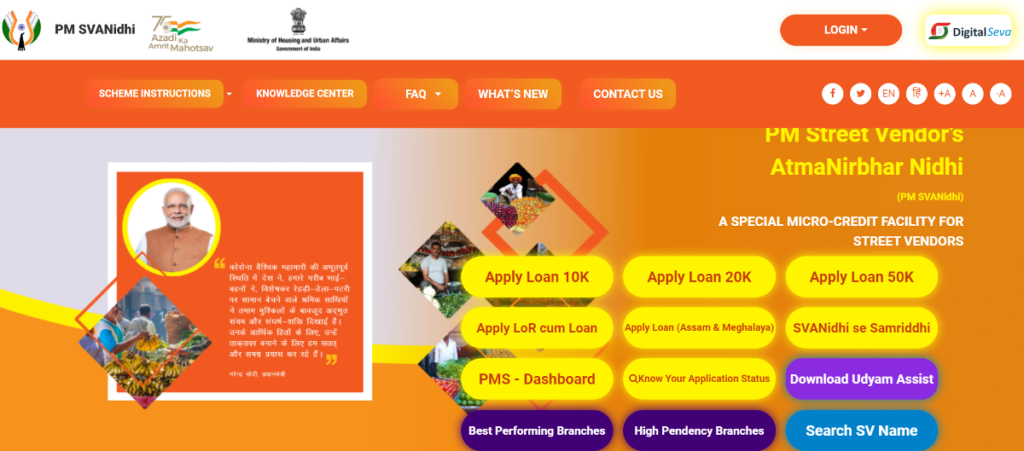

PM SVANidhi Yojana also known as PM Street Vendor’s AtmaNirbhar Nidhi is an empowerment scheme launched by Government of India. Street vendors play a crucial role within the urban informal economy, providing essential goods and services to city residents at affordable rates right at their doorsteps. These vendors are available in various forms such as sabjiwala सब्जीवाला, hawkers फेरीवाला, thelewala ठेलावाला, rehriwala रेहड़ीवाला, and theliphadwala थेलीफडवाला, in different regions. Their services range from fresh produce like vegetables and fruits to ready-to-eat street food, beverages, clothing, footwear, artisan products, and even services like barber shops and laundry. This scheme was launched on June, 2020 to uplift mainly those street vendors whose businesses have been largely affected due to Covid-19 pandemic.

Table of Contents

Objectives of PM SVANidhi Yojana पी एम स्वनिधि योजना:

The initiative is a Central Sector Scheme, fully funded by the Ministry of Housing and Urban Affairs, with the following goals:

1. Facilitate working capital loans up to `10,000.

2. Encourage regular loan repayments.

3. Reward digital transactions.

Eligibility for PM SVANidhi Yojana पी एम स्वनिधि योजना:

- Eligibility by region:

The scheme is accessible to beneficiaries in states and union territories (UTs) that have established Rules and Schemes under the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014. Additionally, street vendors from Meghalaya, which has its own State Street Vendors Act, may participate.

Eligibility for beneficiaries:

The scheme is open to all urban street vendors. Eligible vendors will be identified based on these criteria:

1. Street vendors holding a Certificate of Vending or Identity Card issued by Urban Local Bodies (ULBs).

2. Vendors identified in surveys who haven’t been issued a Certificate of Vending or Identity Card.

3. For vendors identified by ULBs after surveys, provisional Certificates of Vending will be generated through an IT platform. ULBs are encouraged to provide permanent certificates within a month.

4. Vendors recognized by ULBs or Town Vending Committees (TVCs) through Letters of Recommendation (LoRs).

5. Vendors from surrounding rural or peri-urban areas endorsed by ULBs or TVCs through LoRs.

6. Vendors who left urban areas due to the pandemic but plan to return and resume their businesses are also eligible for loans based on the aforementioned eligibility criteria.High-end replica watches offer an exquisite blend of craftsmanship and style, bringing timeless elegance to your wrist. Discover the perfect accessory at http://www.replicachronoshop.com for luxury without compromise.

Entitlement of loan amount under PM SVANidhi Yojana पी एम स्वनिधि योजना:

Street vendors in urban areas will be able to apply for Working Capital (WC) loans for a maximum of Rs.10,000 with a one-year term and monthly payments. The lending institutions will not demand any sort of security in exchange for this loan. Vendors will be qualified for the following cycle of working capital loans with an increased maximum upon timely or early payback. Vendors will not impose a prepayment penalty for payments made earlier than the agreed-upon date.

Rate of Interest and subsidy:

In case of Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Cooperative Banks & SHG Banks, the rates will be as per their prevailing rates of interest. In case of NBFC, NBFC-MFIs etc., interest rates will be as per RBI guidelines for respective lender category. In respect of MFIs (non NBFC) & other lender categories not covered under the RBI guidelines, interest rates under the scheme would be applicable as per the extant RBI

guidelines for NBFC-MFIs.

The vendors who apply for loans through the program are qualified for an interest subsidy of 7%. The borrower will receive the interest subsidy amount on a quarterly basis. For each financial year, the lenders must submit quarterly claims for interest subsidies for the quarters ending on June 30, September 30, December 31, and March 31. The subsidy will only be taken into account for borrowers’ accounts that are Standard (i.e., non-NPA in accordance with the current RBI rules) on the relevant claim dates and only for the months in which the account has remained Standard in the relevant quarter.

When an early payment is made, the admissible amount of subsidy will be credited at one single time.

Lending Institutions under PM SVANidhi Yojana पी एम स्वनिधि योजना:

Financial institutions such as Scheduled Commercial Banks, Regional Rural Banks, Small Financial Banks, Cooperative Banks, Non-banking finance companies, Micro-Finance Institutions, and SHG banks such as Stree Nidhi etc. can lend loans to street vendors under this scheme. However, certain ststes such as Andhra Pradesh and Telengana do not possess Micro-finance Institutions. In such case they are encouraged to utilise their wide network of SHGs and their federations.

Publication of Beneficiary Lists:

Lists of identified street vendors by state, UT, and ULB will be available on relevant ministry, state government, and ULB websites.

Incentive for digital payment:

PM SVANidhi Yojana पी एम स्वनिधि योजना promotes Digital Transactions by Vendors. The scheme will incentivize digital transactions by vendors through cash back facility. The transaction trail so created will build the credit score of vendors for enhancing their future credit needs. The network of lending institutions and digital payment aggregators like NPCI (for BHIM), PayTM, GooglePay, BharatPay, AmazonPay, PhonePe etc. will be used to on-board the street vendors for digital transactions. The onboarded vendors would be incentivised with a monthly cashback in the range of Rs. 50-Rs.100 as per the following criteria:

(i) On executing 50 eligible transactions in a month: Rs.50

(ii) On executing the next 50 additional eligible transactions in a month: Rs. 25 (i.e on reaching 100 eligible transactions, the vendor to receive Rs.75 and

(iii) on executing next additional 100 or more eligible transactions: Rs. 25 (i.e on reaching 200 eligible transactions, the vendor to receive Rs. 100.

An illustration on the cash-back and interest subsidy under the Scheme for a loan amounting to `10,000 is shown in the following table:

| Month | Principal in Rs. (A) | Interest@24% In Rs. (B) | EMI (C) | Interest Subsidy@ 7% (D) | Cashback Incentive (E) | Total Benefit (D+E) |

| 1 | 746 | 200 | 946 | 58 | 100 | 158 |

| 2 | 761 | 185 | 946 | 54 | 100 | 154 |

| 3 | 776 | 170 | 946 | 50 | 100 | 150 |

| 4 | 791 | 154 | 945 | 46 | 100 | 146 |

| 5 | 807 | 139 | 946 | 42 | 100 | 142 |

| 6 | 823 | 122 | 945 | 36 | 100 | 136 |

| 7 | 840 | 106 | 946 | 32 | 100 | 132 |

| 8 | 856 | 89 | 945 | 27 | 100 | 127 |

| 9 | 874 | 72 | 946 | 22 | 100 | 122 |

| 10 | 891 | 55 | 946 | 17 | 100 | 117 |

| 11 | 909 | 37 | 946 | 12 | 100 | 112 |

| 12 | 927 | 19 | 946 | 06 | 100 | 106 |

| Total | Rs. 10,001 | Rs. 1,348 | Rs. 11,349 | Rs. 402 | Rs.1,200 | Rs. 1,602 |

| %w.r.t interest | 100% | 30% of interest | 88% of interest | 118% |

Latest developments under PM SVANidhi Yojana पी एम स्वनिधि योजना:

- The period of extending loan has been extended up to December, 2024 which was earlier fixed until March, 2022. Credit Guarantee and Interest Subsidy claims on all loans will be paid till March, 2028.

- A 3rd period of loan has been introduced under this scheme up to Rs. 50,000 in addition to 1st and 2nd phase of loans.

- To extend ‘SVANidhi Se Samriddhi’ component for all beneficiaries of PM SVANidhi Yojana पी एम स्वनिधि योजना across the country.

- 42 lakh street vendors are to be provided benefits under PM SVANidhi Scheme by December, 2024.

Frequently Asked Questions (FAQs):

Is PM SVANidhi Yojana पी एम स्वनिधि योजना still available?

Yes. It is available until December, 2024.

Which Ministry launched the PM SVANidhi Yojana पी एम स्वनिधि योजना?

The scheme was launched by Ministry of Housing and Urban Affairs, Government of India.

What is the last date for PM SVANidhi Yojana पी एम स्वनिधि योजना?

Lending under the PM SVANidhi Scheme is extended till December, 2024. Credit Guarantee and Interest Subsidy claims on all loans will be paid till March, 2028.

The Digital Personal Data Protection Bill 2023: Safeguarding Privacy in the Digital Age

Pingback: Vishwakarma Yojana विश्वकर्मा योजना : PM Modi Unveils New Scheme on Independence Day 2023 स्वतंत्रता दिवस २0२३ पर पीएम मोदी ने नई योजना का अना

Pingback: PM eBus Sewa 2023: An effective step towards green mobility - WisdomJuncture

Pingback: Assam Mukhya Mantri Sva Niyojan Scheme মুখ্য মন্ত্ৰী স্ব-নিয়োজন আঁচনি 2023 Assam-Incentive amount announced, Eligibility, Benefits, Encouraging Entrepreneurs of Assam - WisdomJuncture